website69.ru

Learn

Fuel Efficient Crossovers 2021

Even though the Plug-In Hybrid model gas mileage ratings have yet to be released, the standard Hybrid trim of the Escape produces the best fuel efficiency. Versatility and fuel-efficiency come together in the Nissan Kicks and the Nissan Rogue. Think room for you and the crew, advanced technology, incedible utility. Whether you are looking for a subcompact crossover like the Kia Niro or a three-row family hauler like the Toyota Highlander, these are the most efficient SUVs. Each of these new Ford SUVs is remarkably fuel efficient - especially the plug-in hybrid variant. It boasts an all-electric driving range of 37 miles and an. Chevrolet's Fuel-Efficient SUVs and Crossovers · Chevrolet Trax (subcompact): EPA-Estimated 24 MPG City / 32 MPG Highway · Chevrolet Trailblazer . Toyota Venza Hybrid: A Zippy, Fuel-Efficient SUV · horsepower · Driving Mode Select between Normal, Eco and Sport modes · The anticipated Venza mpg is an. The all-new Mazda CX-5 is a compact crossover SUV with a fuel-efficient, turbocharged performance. Mazda drivers and shoppers near Orlando, FL. Ford Escape Hybrid SE Sport AWD · Toyota RAV4 Hybrid XLE AWD · Lexus UX FWD · Toyota Highlander Hybrid Platinum AWD · Ford Escape. Midsize Crossovers & SUVs · Audi Q8 e-tron · BMW X5 xDrive50e · EQS SUV by Mercedes-Benz · Porsche Cayenne E-Hybrid · Toyota Highlander Hybrid. Even though the Plug-In Hybrid model gas mileage ratings have yet to be released, the standard Hybrid trim of the Escape produces the best fuel efficiency. Versatility and fuel-efficiency come together in the Nissan Kicks and the Nissan Rogue. Think room for you and the crew, advanced technology, incedible utility. Whether you are looking for a subcompact crossover like the Kia Niro or a three-row family hauler like the Toyota Highlander, these are the most efficient SUVs. Each of these new Ford SUVs is remarkably fuel efficient - especially the plug-in hybrid variant. It boasts an all-electric driving range of 37 miles and an. Chevrolet's Fuel-Efficient SUVs and Crossovers · Chevrolet Trax (subcompact): EPA-Estimated 24 MPG City / 32 MPG Highway · Chevrolet Trailblazer . Toyota Venza Hybrid: A Zippy, Fuel-Efficient SUV · horsepower · Driving Mode Select between Normal, Eco and Sport modes · The anticipated Venza mpg is an. The all-new Mazda CX-5 is a compact crossover SUV with a fuel-efficient, turbocharged performance. Mazda drivers and shoppers near Orlando, FL. Ford Escape Hybrid SE Sport AWD · Toyota RAV4 Hybrid XLE AWD · Lexus UX FWD · Toyota Highlander Hybrid Platinum AWD · Ford Escape. Midsize Crossovers & SUVs · Audi Q8 e-tron · BMW X5 xDrive50e · EQS SUV by Mercedes-Benz · Porsche Cayenne E-Hybrid · Toyota Highlander Hybrid.

Explorer Limited Hybrid Trim Gas Mileage · L V6 Hybrid engine · net system horsepower · lb-ft of net system torque · EPA-estimated 27 city/ Chevrolet's Fuel-Efficient SUVs and Crossovers · Chevrolet Trax (subcompact): EPA-Estimated 24 MPG City / 32 MPG Highway · Chevrolet Trailblazer . Explorer Limited Hybrid Trim Gas Mileage · L V6 Hybrid engine · net system horsepower · lb-ft of net system torque · EPA-estimated 27 city/ The Four Most Fuel-Efficient SUVs from Chevy ; Chevy Trailblazer. Compact SUV; MSRP from $23, MSRP; Standard L ECOTEC turbocharged engine / hp ; Chevy. Rounding out the top five most efficient small SUVs are the Honda CR-V Hybrid (38 mpg combined) and the Subaru Crosstrek Hybrid (35 mpg combined). The Ford Escape Hybrid, Ford Escape, and Ford Bronco Sport are the most fuel-efficient SUVs in the Ford lineup. Learn more about their mpg ratings with. The Four Most Fuel-Efficient SUVs from Chevy ; Chevy Trailblazer. Compact SUV; MSRP from $23, MSRP; Standard L ECOTEC turbocharged engine / hp ; Chevy. The Toyota RAV4 is one of the most popular Toyota SUVs. Available in gas-powered, hybrid, and plug-in hybrid versions, the RAV4 is among the most fuel-efficient. Chevy Blazer The Chevy Blazer was reintroduced into the Chevy lineup in , and it's more popular than ever! With a L 4-cylinder engine, the Blazer. Ford Escape Hybrid SE Sport AWD · Toyota RAV4 Hybrid XLE AWD · Lexus UX FWD · Toyota Highlander Hybrid Platinum AWD · Ford Escape. SUV enthusiasts can gear-up for some exciting new collection of SUVs with advanced features and fuel-efficient drivetrains. Here are the most fuel-efficient. Larger families may be more interested in Chevy's most fuel-efficient midsize SUV, the Blazer. Chevy SUV Model. Size Category. Estimated Gas Mileage. A Look at Today's Most Fuel-Efficient SUVs ; Nissan Rogue · Starting MSRP: $27,; EPA Estimated City/Highway MPG: 30/37 ; Hyundai Kona · Starting MSRP: $21, Chevrolet Trailblazer: EPA-Estimated 29 MPG City / 33 MPG Highway. How to Improve Fuel Efficiency. Whether you pick one of the most fuel-efficient SUVs from the. Midsize Crossovers & SUVs · Audi Q8 e-tron · BMW X5 xDrive50e · EQS SUV by Mercedes-Benz · Porsche Cayenne E-Hybrid · Toyota Highlander Hybrid. The all-new Lincoln Corsair is a compact luxury SUV. This Lincoln model offers a plug-in hybrid option for for an even more fuel-conscious drive. Top Three Cadillac SUV MPG Ratings · Cadillac XT4 FWD: 23 mpg city / 30 mpg highway · Cadillac XT4 AWD: 22 mpg city / 29 mpg highway. Most Fuel Efficient SUV · Fuel-Efficient SUVs: Cadillac XT4. Arguably one of the most fuel-efficient midsize SUVs on the Graham market is the XT4. · Fuel-. If you want a spacious and fuel-efficient SUV, then you should consider the Ford Escape. This compact crossover combines fuel-efficient and sporty.

Which Is Best Debit Card Or Credit Card

A credit card may be your best choice for big purchases such as plane tickets, accommodation, transportation, car rentals and pricier meals. Signature debit card transactions offer consumers better fraud protection than PIN charges, so we typically recommend selecting the credit option at checkout. 1. Credit cards often offer better fraud protection · 2. Using a credit card can help build good credit · 3. Paying with a debit card can help manage credit card. However, at some banks you can earn interest on the money in your checking account. How do debit cards work? Your debit card places a hold on the purchase. Debit cards attach directly to your checking or savings account. They work like cash. When you make a purchase, the money gets withdrawn immediately and. Debit is the most popular payment method for a reason: It gives you safe, instant access to the money that's already in your checking account. Debit cards use your own money, credit cards are borrowing money that you will have to pay back. Use credit cards only if you have a good salary. In terms of usage, there is generally no difference between Debit Cards and Credit Cards. Both can be used at merchant outlets and online. However, there may be. And, unlike debit cards that often carry a maximum daily spending limit, credit cards are perfect for purchasing larger items. A credit card may be your best choice for big purchases such as plane tickets, accommodation, transportation, car rentals and pricier meals. Signature debit card transactions offer consumers better fraud protection than PIN charges, so we typically recommend selecting the credit option at checkout. 1. Credit cards often offer better fraud protection · 2. Using a credit card can help build good credit · 3. Paying with a debit card can help manage credit card. However, at some banks you can earn interest on the money in your checking account. How do debit cards work? Your debit card places a hold on the purchase. Debit cards attach directly to your checking or savings account. They work like cash. When you make a purchase, the money gets withdrawn immediately and. Debit is the most popular payment method for a reason: It gives you safe, instant access to the money that's already in your checking account. Debit cards use your own money, credit cards are borrowing money that you will have to pay back. Use credit cards only if you have a good salary. In terms of usage, there is generally no difference between Debit Cards and Credit Cards. Both can be used at merchant outlets and online. However, there may be. And, unlike debit cards that often carry a maximum daily spending limit, credit cards are perfect for purchasing larger items.

Credit cards offer better fraud protection than debit cards. For example, you won't pay more than $50 for fraudsters swiping your card (once reported), but you. Debit cards are a quick way to spend money directly from your checking account, allowing you to access your balance in real time. Both a Debit and Credit Card are similar in terms of facilities and ease of use. In case you use a Credit Card for shopping, you realise benefits such as. Debit cards offer the convenience of not needing to carry cash or checks. When money is required, you can withdraw from an automated teller machine (ATM). Even. Debit cards won't affect your credit score. · Debit cards don't charge interest. · Credit cards often pay rewards. · Credit cards have better consumer protections. Instead, your debit card is linked to your checking account at your financial institution of choice, and money is pulled right from your account whenever you. The biggest difference between a credit card and a debit card lies in where the funds come from. Remember, paying with a credit card means borrowing money from. The advantages of using a debit card over a credit card include avoiding debt, no credit checks required for approval, no interest charges. No Debt Accumulation: Since you're using your own money, there's no risk of accumulating debt with a debit card. This makes it an excellent tool for those who. Debit cards are linked to your bank account, so every time you make a purchase, the amount is immediately deducted from your account balance. Credit cards are. The advantages of using a debit card over a credit card include avoiding debt, no credit checks required for approval, no interest charges. We'll go over the advantages and disadvantages of debit cards vs. credit cards. Plus, we'll answer when's the best time to use each card. Debit and credit cards both allow cardholders to obtain cash and make purchases. · Debit cards are linked to the user's bank account and limited by how much. A credit card offers a line of credit that acts like a mini loan, meaning you're not limited to the amount in your bank account. · A debit card instantly deducts. When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to. If you are making a transaction when the receiving party needs the money right away, use of debit card is the best choice. You're on a budget. Since the. Debit cards will not help you build your credit, so a credit card might be a better option if this is one of your goals. When using a debit card, if your. The primary benefit of debit cards is they make it more difficult to spend money you don't have! If you're working within a tight budget, using a debit card may. In this case, even though it was swiped as a credit card, it is still considered a debit card transaction. While it may take a few days, the purchase price will. When you choose to run your debit card as credit, you sign your name for the transaction instead of entering your PIN. The transaction goes through Visa's.

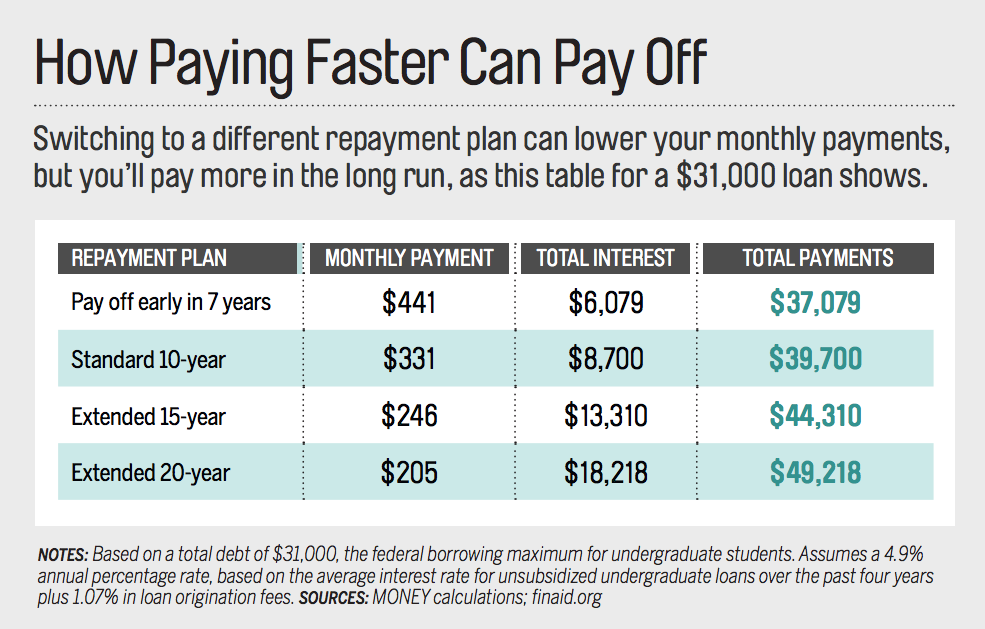

How Long To Repay Student Loan Calculator

This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much. Asking yourself when you will finally have your student loans paid off? Use our payoff calculator and see for yourself. Purefy's student loan payoff calculator helps you see how long it will take to get out of debt! See how extra payments, lower rates, and terms affect your. You may also enter the current amount of student loans you have already borrowed, and any future anticipated borrowing and the calculator will return the salary. Free calculator to evaluate student loans by estimating the interest cost, helping to understand the balance, and evaluating pay-off options. This student loan payoff calculator shows how much money you save when you make an extra student loan payment or increase your monthly student loan payment. Using the Student Loan Payoff Calculator, you can see it would take until August – a full 10 years – to pay off your student debt and result in an. How long until my loan is paid off? By making consistent regular payments toward debt service you will eventually pay off your loan. Use this calculator to. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time. This Loan Payment Calculator computes an estimate of the size of your monthly loan payments and the annual salary required to manage them without too much. Asking yourself when you will finally have your student loans paid off? Use our payoff calculator and see for yourself. Purefy's student loan payoff calculator helps you see how long it will take to get out of debt! See how extra payments, lower rates, and terms affect your. You may also enter the current amount of student loans you have already borrowed, and any future anticipated borrowing and the calculator will return the salary. Free calculator to evaluate student loans by estimating the interest cost, helping to understand the balance, and evaluating pay-off options. This student loan payoff calculator shows how much money you save when you make an extra student loan payment or increase your monthly student loan payment. Using the Student Loan Payoff Calculator, you can see it would take until August – a full 10 years – to pay off your student debt and result in an. How long until my loan is paid off? By making consistent regular payments toward debt service you will eventually pay off your loan. Use this calculator to. Use our student loan calculator to help you estimate your payments and interest. Create a repayment plan to ensure you repay your student loans on time.

How long will it take to pay off my loan? Use this loan payoff calculator to find out how many payments it will take to pay off a loan. All fields are. Income-driven repayment (IDR) plans — Federal student loans allow you to switch from the standard year repayment schedule to an IDR, often running 20 or Thinking about becoming debt-free faster? If you're looking to make extra payments now, use this calculator to estimate how much time and money you will save in. SmartAsset's student loan payoff calculator shows what your monthly loan payments will look like and how your loans will amortize over time. Tired of your student loans? Our student loan payoff calculator helps you determine your payoff date as well as how to pay off your student loans faster. Tired of your student loans? Our student loan payoff calculator helps you determine your payoff date as well as how to pay off your student loans faster. Know what you'll need to borrow. Explore repayment plans. Identify loan consolidation and refinancing options. Determine how much you can have forgiven. You can estimate your payments with various interest rates and loan terms using this calculator. Please enter the amount of your loan, the annual interest rate. Student Loan Calculator - BETA How long will it take you to pay off the debt from your health professional education? Use our Student Loan Calculators to see. repayment plans and slowly reduce debt over the long term. Also, this process cannot discharge obligations such as tax debt, student loan debt, child support. Use the student loan repayment calculator from Discover Student Loans to see how extra payments can reduce the cost and duration of your loan. The Student Loan Payoff Calculator helps by showing how much time and money you'll save if you add various amounts to your monthly payment. How It Works. Enter. The Repayment Calculator can be used to find the repayment amount or length of debts, such as credit cards, mortgages, auto loans, and personal loans. It can be. The Student Loan Payoff Calculator helps by showing how much time and money you'll save if you add various amounts to your monthly payment. Based on your loans and income, you qualify for 7 repayment plans. Choose a plan below to see how it compares to all the others. Standard Fixed. Monthly. How Much Will My Student Loan Payment Be? Our calculator will help you estimate your: You may have other loan repayment options based on your loan type. If you are a student with a plan 1, 2, 4, 5 or postgraduate student loan, you only make repayments if your pre-tax salary is above the repayment threshold. Your. Student Loan Repayment Calculator. Estimate your student loan payments under Mapping Your Future's mission is to enable individuals to achieve life-long. Examples of How Long It Will Take to Pay Off $40, in Student Loans ; Debt, Monthly Payment, Payoff Time, Total Interest Accrued ; $40,, $, 10 years. how long you'll need. Monthly payment: Once you start to pay back your student loan, this is the amount due each month. The longer the term, the lower your.

Protective Life Rating

So I am wondering if there are compliance issues that Life Insurance companies must obey (ie. must manually review all changes to combat fraud. It might help to look at each company's customer reviews and claims process to find the best fit for you. Upvote. Protective Life Insurance Review · Seven different universal life insurance policies to choose from · One plan offers premiums that are payable up to age Protective Life ; S&P rating, AA- Very Strong (4th of 21 ratings) ; phone number, () ; agent commission, We are paid from the insurance company general. Protective Life Insurance is a company worth checking out if you're in the market for a term or whole life insurance policy. Protective Life ticks all the. Protective Life Insurance Company, independent ratings, Comdex ranking 93, Comdex is a composite ranking of an insurer's ratings on a scale of 1 - Life insurance company ratings are essentially the opinion of an independent agency regarding the financial health of the insurance company it rates. Protective is by far the best company for life insurance known as Guaranteed Universal Life Insurance. Protective primarily offers two variations of this type. At a glance · Offers term life insurance coverage up to $50 million · Provides term, whole and universal life insurance options · Rated A (Excellent) by AM Best. So I am wondering if there are compliance issues that Life Insurance companies must obey (ie. must manually review all changes to combat fraud. It might help to look at each company's customer reviews and claims process to find the best fit for you. Upvote. Protective Life Insurance Review · Seven different universal life insurance policies to choose from · One plan offers premiums that are payable up to age Protective Life ; S&P rating, AA- Very Strong (4th of 21 ratings) ; phone number, () ; agent commission, We are paid from the insurance company general. Protective Life Insurance is a company worth checking out if you're in the market for a term or whole life insurance policy. Protective Life ticks all the. Protective Life Insurance Company, independent ratings, Comdex ranking 93, Comdex is a composite ranking of an insurer's ratings on a scale of 1 - Life insurance company ratings are essentially the opinion of an independent agency regarding the financial health of the insurance company it rates. Protective is by far the best company for life insurance known as Guaranteed Universal Life Insurance. Protective primarily offers two variations of this type. At a glance · Offers term life insurance coverage up to $50 million · Provides term, whole and universal life insurance options · Rated A (Excellent) by AM Best.

We're independent agents representing Protective Life. Contact us if you need help purchasing a life insurance policy. The service is free of charge. You can shop both term and permanent life insurance policies from Protective Life through SelectQuote. Learn more about your options for life insurance coverage. Another great rider provided by Protective Life Insurance. This rider allows you to buy additional coverage later on when you think you may be needing it the. Like a consumer credit rating agency, A.M. Best is another independent firm that measures an insurance company's ability to pay claims and meet other financial. Rating, Action, Date, Type. AA-, Affirmed, May, Long Term Insurer Financial Strength. F1+, Affirmed, May, Short Term Insurer Financial. Protective Life Insurance Company, Protective Life and Annuity Insurance Company and West Coast Life Insurance Company – Insurance Financial Strength (IFS) to. Protective Life has an overall rating of out of 5, based on over reviews left anonymously by employees. 69% of employees would recommend working at. Furthermore, the Protective Life Insurance rating from Standard and Poor's is A+ which is also very strong. protective life insurance. Protective Permanent Life Insurance Choices · Custom Choice – A low-cost term alternative policy · Advantage Choice – Universal life with cash value. Ratings ; AM Best. A+ ; Fitch. AA- ; Standard & Poor's. AA- ; Moody's. A1. This organization is not BBB accredited. Life Insurance in Birmingham, AL. See BBB rating, reviews, complaints, & more. Check out our review and this profile of Protective Life & Annuity Insurance Company; which is rated “A+” by A.M. Best, was founded in , and has over $5. Protective Life Insurance Company's Financial Strength and BBB Ratings · A.M. Best: A+ · Fitch: A+ · Moody's: A2 · Standard and Poor's: AA- · Comdex Score: Another great rider provided by Protective Life Insurance. This rider allows you to buy additional coverage later on when you think you may be needing it the. Protective Life Insurance is a company worth checking out if you're in the market for a term or whole life insurance policy. Protective Life ticks all the. Protective is our top choice for best term life insurance company. This is because it tied for having the lowest term rates of the companies we reviewed and is. NEW YORK (S&P Global Ratings) May 11, S&P Global Ratings said today that it assigned its 'A-2' short-term issue credit rating to Protective Life Corp's. . the Protective Life Insurance Company. With some of the most competitive rates and an impressive A+ financial rating, Protective Life Insurance is dedicated to. How many stars would you give Protective Life? Join the 9 people who've already contributed. Your experience matters. Fixed Annuities. Protective Life offers two different fixed annuities. The first is the Protective Secure Saver, which allows customers more access to their.

Projects On Data Science

Reinforce your skills by working on real-world data science projects. Expand your analytical thinking, experiment with technologies, and boost your portfolio. DataWars is a Project-based playground with + ready-to-solve, interactive, Data Science projects. Practice your skills solving real life challenges in. This guide to building a data science portfolio also offers a good overview of different kinds of projects possible: data cleaning, data storytelling, an "end. Every project brings together a team of expert authors, instructors, and technical editors. You'll find step-by-step guidance from start to finish, complete. A data science game generates data—lots of data—as you play. And the only Research Projects · Publications. Opportunities. Careers · Fellows Program · Work. This guide synthesizes the successful project practices from dozens of leading data science organizations spanning many sizes and industries. Solve real-world problems in Python, R, and SQL. Grow your coding skills in an online sandbox and build a data science portfolio you can show employers. Dataquest learners spend their time working through real-world data challenges that teach learners to combine multiple skills and tools to solve a problem or. 3 real-life data science portfolio examples that got my foot in the door at 12 companies, and 1 that almost got me tossed out. Reinforce your skills by working on real-world data science projects. Expand your analytical thinking, experiment with technologies, and boost your portfolio. DataWars is a Project-based playground with + ready-to-solve, interactive, Data Science projects. Practice your skills solving real life challenges in. This guide to building a data science portfolio also offers a good overview of different kinds of projects possible: data cleaning, data storytelling, an "end. Every project brings together a team of expert authors, instructors, and technical editors. You'll find step-by-step guidance from start to finish, complete. A data science game generates data—lots of data—as you play. And the only Research Projects · Publications. Opportunities. Careers · Fellows Program · Work. This guide synthesizes the successful project practices from dozens of leading data science organizations spanning many sizes and industries. Solve real-world problems in Python, R, and SQL. Grow your coding skills in an online sandbox and build a data science portfolio you can show employers. Dataquest learners spend their time working through real-world data challenges that teach learners to combine multiple skills and tools to solve a problem or. 3 real-life data science portfolio examples that got my foot in the door at 12 companies, and 1 that almost got me tossed out.

Play the role of a Data Scientist / Data Analyst working on a real project. Demonstrate your Skills in Python - the language of choice for Data Science and. Latest Data Science Projects List using Regression Neural Networks Decision Tree SVM algorithms with Free Synopsis PPT and Source code downloads. A logical, flexible, and reasonably standardized project structure for doing and sharing data science work. Explore end-to-end data science projects for real-world business cases. Learn project design, documentation, and MLOPS practices with MLFLOW and Wandb. Explore ProjectPro's Solved End-to-End Real-Time Machine Learning and Data Science Projects with Source Code to accelerate your work and career. When contracting freelance data science projects, potential clients will often favor data scientists who have experience in their industry, easing the. The three steps to choosing a data science project for your data science portfolio are as follows (with further explanation below). Data Science Projects · Real-time facial landmark detection · Eye blink detection · Drowsiness detection with OpenCV · DataFlair - System with OpenCV & Keras. Read writing about Projects in Towards Data Science. Your home for data science. A Medium publication sharing concepts, ideas and codes. This guide synthesizes the successful project practices from dozens of leading data science organizations spanning many sizes and industries. Data Science offers real-life data science projects designed to help apply your skills in business contexts and add Python, R, SQL, Tableau, Excel, data. Data Science Discovery Projects · Fall Award Winners · Discovery Projects · Predicting Overall Team Performance From Physiological Signals · Optimizing. Explore our list of data analytics projects for beginners, final-year students, and professionals. The list consists of guided/unguided projects and tutorials. projects. Practice Project A/B Test for MuscleHub. Python • Data Science. Help the MuscleHub gym determine the best fitness test format by conducting A/B. A good data science project must meet certain criteria, including relevance, complexity, potential impact, and a process of iteration and improvement. These projects consists of time series forecasting, computer vision, natural language processing, recommender system. Below are the some data science projects. Above projects you can get from Kaggle and then are simple to understand as well as explain. We have collected for you sixteen data science projects with source code so you can actually participate in the real-time projects of data science. Below are some examples of original research studies done by students in our master's in Applied Data Science program for their completed capstone projects. Read writing about Projects in Towards Data Science. Your home for data science. A Medium publication sharing concepts, ideas and codes.

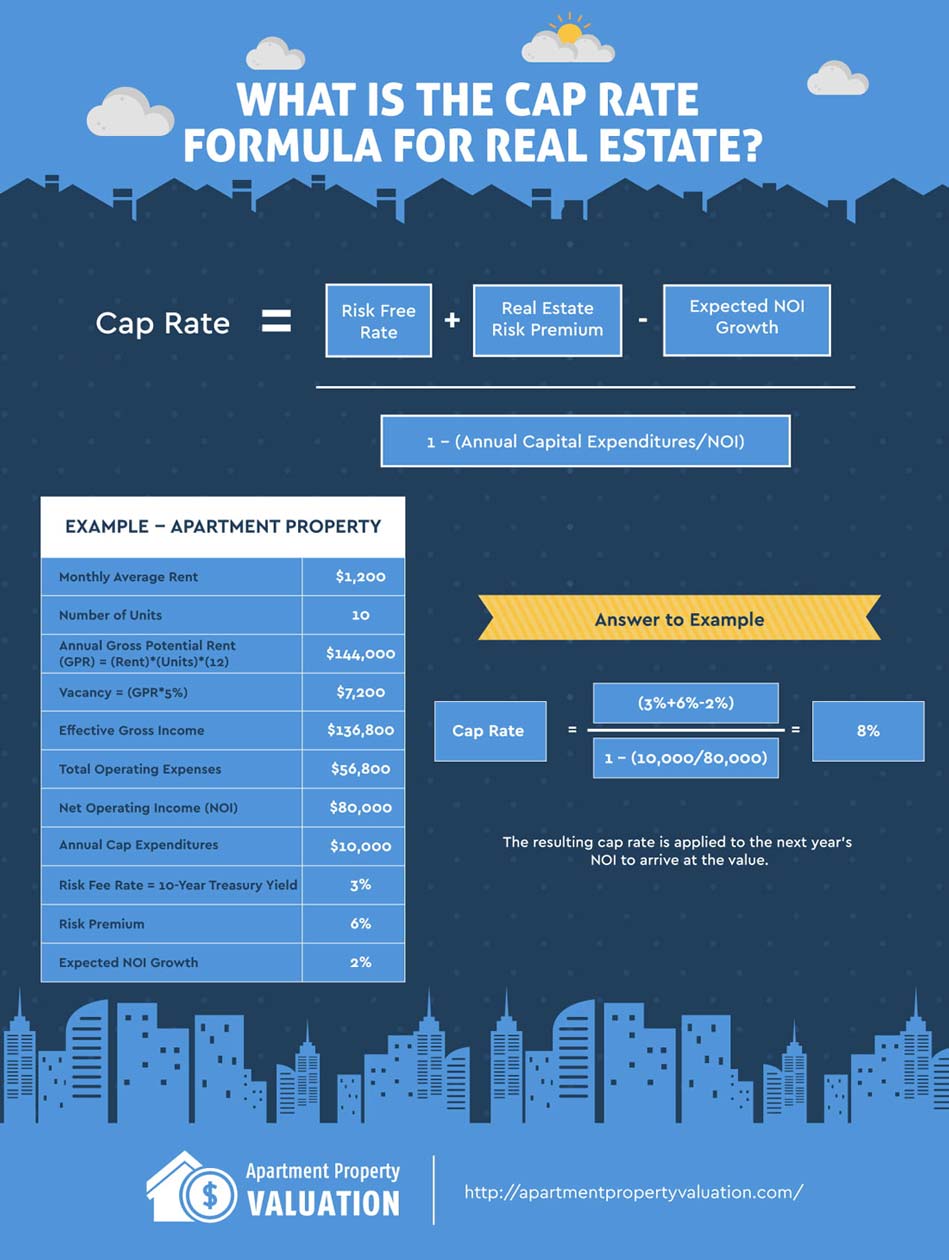

Cap Rate High Or Low

A higher cap rate will therefore result in a lower property value, NOI being equal. Obviously, then, application of a cap rate that is too high to the. A higher cap rate tends to correlate with higher-risk assets as an investor would pay less for a risky income stream (lower denominator) with the potential for. A low cap rate indicates a lower risk investment with stable, long-term cash flows. Properties with low cap rates are typically high-quality assets in prime. These days, a cap rate of percent for single-family rentals in many hot markets is a more reasonable expectation. Some investors believe that properties. At the most basic level, a lower cap rate indicates a lower A high cap rate indicates a higher risk investment with the potential for larger returns. Whether an investor deems a cap rate “good” is a direct reflection of whether or not they think the investment's return matches its perceived risk. For example. Overall, the higher the cap rate, the riskier the investment. That is, a high cap rate means your asset price is low, which typically points to a riskier. A higher cap rate means the market sees more risk and demands higher returns. A lower cap rate means the market sees lower risk so they are willing to. A higher cap rate generally indicates a higher potential return on investment, while a lower cap rate suggests a lower potential return. How To Calculate Cap. A higher cap rate will therefore result in a lower property value, NOI being equal. Obviously, then, application of a cap rate that is too high to the. A higher cap rate tends to correlate with higher-risk assets as an investor would pay less for a risky income stream (lower denominator) with the potential for. A low cap rate indicates a lower risk investment with stable, long-term cash flows. Properties with low cap rates are typically high-quality assets in prime. These days, a cap rate of percent for single-family rentals in many hot markets is a more reasonable expectation. Some investors believe that properties. At the most basic level, a lower cap rate indicates a lower A high cap rate indicates a higher risk investment with the potential for larger returns. Whether an investor deems a cap rate “good” is a direct reflection of whether or not they think the investment's return matches its perceived risk. For example. Overall, the higher the cap rate, the riskier the investment. That is, a high cap rate means your asset price is low, which typically points to a riskier. A higher cap rate means the market sees more risk and demands higher returns. A lower cap rate means the market sees lower risk so they are willing to. A higher cap rate generally indicates a higher potential return on investment, while a lower cap rate suggests a lower potential return. How To Calculate Cap.

For example, a property with a healthy, stable income will likely trade at a higher price, and therefore carry a lower cap rate. While the low CRE cap rate. The lower the cap rate, the lower the perceived risk of a particular investment is and thus the higher the cost of the asset. As an example, Multi-Family. Cap Rate—short for Capitalization Rate—is a measure of the expected rate of return on a real estate investment, such as a commercial rental property. It is useful to note that different cap rates represent different levels of risk – a low cap rate implies lower risk while a high cap rate implies higher risk. Higher the cap rate generally means the more risky the investment is. High risk high reward. Lower cap rates are the opposite. Now the. Is a Higher or Lower Cap Rate Better? The higher the capitalization rate, the riskier the multifamily apartment is as an investment. Cap Rate Predictions for. Investors hoping for deals with a lower purchase price may, therefore, want a high cap rate. Following this logic, a cap rate between four and ten percent may. A lower cap rate often signifies a lower potential return but comes with reduced risk. Lower cap rate properties are frequently more stable and established. If the cap rate is lower than the interest rate, you'll be relying on appreciation for your return, making it a riskier speculative investment. How to calculate. Clearly a high cap rate is a positive sign about a potential real estate investment to an investor looking for their next asset. That said, most homebuyers will. In commercial real estate, a good cap rate falls between 4% to 10%. The range signifies varying levels of risk; a cap rate above 7% might be considered riskier. Low Cap Rate: (3%–%). Medium Cap Rate: (%–8%). High Cap Rate: (8% or higher). Distinguishing. Properties with higher cap rates tend to have more inherent risk, while those with lower cap rates tend to carry lower risks. Property prices are inversely. In their research, high/mid/low cap rate properties are identified as follows: high cap rates are the highest 30 percent of cap rates, mid-cap rates are the. The higher the cap rate, the more income an investor can expect in relation to the asset's purchase price. Cap rate compression refers to rising market prices. Generalizing quite a bit, a cap rate of 7% or higher is considered a good cap rate. However, this can vary depending on the market conditions and the type of. Investors have differing opinions as to whether or not a low cap rate is a good thing. In general, markets with low cap rates are high demand investment. This is due to lower cap rates indicating higher demand for properties with potentially higher returns. Alternatively, a higher NOI means that a property is. A high cap rate indicates the property is less expensive with a higher return (but greater risk). While the cap rate helps investors assess property potential.

What Is The Average Home Insurance Cost Per Month

Using the same data, the average monthly cost of home insurance is $ You may be able to make monthly payments through an escrow, meaning you submit one. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Homeowners insurance on a $ home costs $ per year, on average insurance companies give you the flexibility to choose between annual or monthly. If you choose a higher deductible, the annual premium for your insurance policy will likely be lower. The downside? If you have to make a claim for repairs to. For example, Florida residents pay the highest average premiums, at $2, per year, according to III data, while Oregon residents pay an average of just $ Average homeowners insurance in NY ; Erie County, $1,, $91 ; Monroe County, $1,, $85 ; Suffolk County, $3,, $ What is the average cost of home insurance in Calgary? · The monthly average for Calgary home insurance is $ · The monthly range for Calgary home insurance is. The average annual premium for homeowners insurance in the United States is $1, per year or about $ per month. Among the myriad factors insurance. Using the same data, the average monthly cost of home insurance is $ You may be able to make monthly payments through an escrow, meaning you submit one. The national average for condo insurance is $ a year. This was for a policy with $60, in personal property coverage, $, in liability protection and. The average cost of homeowners insurance for a month policy from the insurers in Progressive's network ranges from $ ($83/month) to $ ($/month). Homeowners insurance on a $ home costs $ per year, on average insurance companies give you the flexibility to choose between annual or monthly. If you choose a higher deductible, the annual premium for your insurance policy will likely be lower. The downside? If you have to make a claim for repairs to. For example, Florida residents pay the highest average premiums, at $2, per year, according to III data, while Oregon residents pay an average of just $ Average homeowners insurance in NY ; Erie County, $1,, $91 ; Monroe County, $1,, $85 ; Suffolk County, $3,, $ What is the average cost of home insurance in Calgary? · The monthly average for Calgary home insurance is $ · The monthly range for Calgary home insurance is. The average annual premium for homeowners insurance in the United States is $1, per year or about $ per month. Among the myriad factors insurance.

In Missouri, where we center our practice, the average cost of home insurance for a year is $1, — around $ per month — for a $, home. This rate. Using the same data, the average monthly cost of home insurance is $ You may be able to make monthly payments through an escrow, meaning you submit one. Will be $ per month. Most prices for insuring a similar home are around the same. I'd imagine the average cost to be around progressives. The cheapest company for a new build home was Progressive, with an average monthly payment of just $44 — $36 less than the national average. AVERAGE PREMIUMS BY. Sinkholes are also a danger to Florida homes. Avg. premium for $k dwelling coverage $ 5, /yr Best home insurance in Florida. Your home age impacts the price you pay for Houston homeowners Insurance up to $ per year. Houston home insurance shoppers with older homes pay 56% higher. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. By answering a few questions about your net worth, deductible preference, and the cost to rebuild your home and replace your belongings, our property insurance. A one bedroom property costs £ on average to insure, but that goes up to £ for a four bedroom home, a 70% increase. Monthly vs. annual payments. It's. $ a month, yes, that sounds reasonable per month, maybe a little high on a home that costs that much. I'd shop. Totally depends on where you live. In Missouri, where we center our practice, the average cost of home insurance for a year is $1, — around $ per month — for a $, home. This rate. The Average home insurance cost in Ottawa is around $1, per year or $ per month for your premium. Ottawa's home insurance rate is higher than the. An insurance premium, also known as a rate, is the amount you pay for an insurance policy. This can be paid on a monthly or annual basis. When you fill out a. The average annual premium for homeowners insurance in the United States is $1, per year or about $ per month. Among the myriad factors insurance. Lemonade homeowners insurance policies start at as low as $25/month. However, your personalized price depends on a variety of factors, including: Your. Landlord insurance policies usually cost about 25% more than homeowners insurance policies, according to the Insurance Information Institute. The average. The average cost of homeowners insurance in Sarasota, Florida is $3, per year for a $, house, $6, for a $, house and $8, for a $, Alberta has the highest insurance premiums in Canada. Residents with a home valued between $, and $1,, pay $ per month on average. Forest fires. Nationally, homeowners pay an average premium of $ per year.

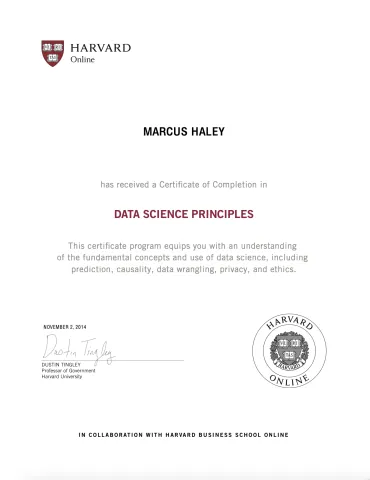

Data Science Harvard Online

Course description. Perhaps the most popular data science methodologies come from machine learning. What distinguishes machine learning from other computer. Harvard University Master of Science in Data Science course fees, scholarships, eligibility, application, ranking and more. Know How to get admission into. The HarvardX Data Science program prepares you with the necessary knowledge base and useful skills to tackle real-world data analysis challenges. Harvard University currently offers most of its courses free of charge in data science. There are more than 20 online courses available. Harvard Professional Certificate in Data Science is an introductory learning and career oriented learning path for the Data Science world. It's a masters degree from an accredited university. Don't expect people to treat it like Harvard, but it's still a learning experience. Data Science Principles is a Harvard Online course that gives you an overview of data science with a code- and math-free introduction to prediction, causality. Harvard University, renowned for its academic excellence, provides a robust selection of data science courses designed to equip learners with the necessary. This course focuses on using Python in data science. By the end of the course, you'll have a fundamental understanding of machine learning models and basic. Course description. Perhaps the most popular data science methodologies come from machine learning. What distinguishes machine learning from other computer. Harvard University Master of Science in Data Science course fees, scholarships, eligibility, application, ranking and more. Know How to get admission into. The HarvardX Data Science program prepares you with the necessary knowledge base and useful skills to tackle real-world data analysis challenges. Harvard University currently offers most of its courses free of charge in data science. There are more than 20 online courses available. Harvard Professional Certificate in Data Science is an introductory learning and career oriented learning path for the Data Science world. It's a masters degree from an accredited university. Don't expect people to treat it like Harvard, but it's still a learning experience. Data Science Principles is a Harvard Online course that gives you an overview of data science with a code- and math-free introduction to prediction, causality. Harvard University, renowned for its academic excellence, provides a robust selection of data science courses designed to equip learners with the necessary. This course focuses on using Python in data science. By the end of the course, you'll have a fundamental understanding of machine learning models and basic.

This course covers the basics of data visualization and exploratory data analysis. We will use three motivating examples and ggplot2, a data visualization. Learning from data in order to gain useful predictions and insights. This course introduces methods for five key facets of an investigation: data wrangling. The Harvard University Data Science program ranking is #1 by Global (QS ) This article guides aspirants about how to apply for the Harvard Data Science. Harvard University currently offers most of its courses free of charge in data science. There are more than 20 online courses available. Learn key data science essentials, including R and machine learning, through real-world case studies to jumpstart your career as a data scientist. The U.S. Open is coming up. Did you know some of the world's biggest sports events can be analyzed by data science fundamentals? The HarvardX data science professional certificate program from Harvard University gives you the skills to tackle real-world data analysis & challenges. In this online course taught by Harvard Professor Rafael Irizarry, build a movie recommendation system and learn the science behind one of the most popular. The Harvard University Data Science program ranking is #1 by Global (QS ) This article guides aspirants about how to apply for the Harvard Data Science. Harvard's CSA course is an introductory course in data science, designed for students with some prior programming experience. The course covers a broad. Learn the benefits of data-driven decision making for your organization by exploring business analytics and data science. The HBS Business Analytics Program is an online certificate for experienced professionals, to explore new ways to analyze, interpret data to drive business. Explore 32 online data science courses and learning programs from Harvard University, the 1st ranked university in the world. Harvard Professional Certificate in Data Science is an introductory learning and career oriented learning path for the Data Science world. This is probably the best hands-on course on Data Science and machine learning online. In this course, you will learn to create Machine Learning Algorithms in. As an open access platform of the Harvard Data Science Initiative, Harvard Data Science Review (HDSR) features foundational thinking, research milestones. Our latest cohort of Data Science Principles starts today! Learners in this cohort will explore major data science concepts – like uncertainty. Harvard's CSA course is an introductory course in data science, designed for students with some prior programming experience. The course covers a broad. In August , I enrolled in the first class, of nine, in Harvard University's Professional Certificate in Data Science via edX. Main Focus. Harvard Online offers the Data Science Principles course which is a code and math free introduction to key data science concepts with a focus on how.

Is Metlife Dental Good

Metlife has an average rating of from reviews. The rating indicates that most customers are generally dissatisfied. The official website is website69.ru High Option · $3,/$3, annual plan maximum per person · Orthodontia coverage for dependent children up to age 19 · No cost for in‐network cleanings, X‐. Horrible customer service. I have metlife dental when I use it as my insurance I have to pay $ out of pocket for my kids cleanings. What you pay: The percentage you pay (this is called 'co-insurance') will vary depending on the type of treatment you are having: Restorative treatment, such as. Having MetDental Insurance can provide you with a maximum benefit per year that is reasonable and does not limit you to the most minimal of treatment to get you. The Scheduled Reimbursement DPPO plan covers a set amount regardless of what the dentist bills. The Coinsurance DPPO plan covers a set percentage based on the. Overall, MetLife offers extensive benefits to its members, making it one of the best dental insurance providers. It offers comprehensive dental services and PPO. The MetLife dental plans are the traditional indemnity insurance plan How do I know if a dentist is in the MetLife. Preferred Dentist Program (PDP)?. MetLife TakeAlong Dental · Expansive network of dental providers · More savings when you stay in-network · No paperwork; in- or out-of-network dentists submit. Metlife has an average rating of from reviews. The rating indicates that most customers are generally dissatisfied. The official website is website69.ru High Option · $3,/$3, annual plan maximum per person · Orthodontia coverage for dependent children up to age 19 · No cost for in‐network cleanings, X‐. Horrible customer service. I have metlife dental when I use it as my insurance I have to pay $ out of pocket for my kids cleanings. What you pay: The percentage you pay (this is called 'co-insurance') will vary depending on the type of treatment you are having: Restorative treatment, such as. Having MetDental Insurance can provide you with a maximum benefit per year that is reasonable and does not limit you to the most minimal of treatment to get you. The Scheduled Reimbursement DPPO plan covers a set amount regardless of what the dentist bills. The Coinsurance DPPO plan covers a set percentage based on the. Overall, MetLife offers extensive benefits to its members, making it one of the best dental insurance providers. It offers comprehensive dental services and PPO. The MetLife dental plans are the traditional indemnity insurance plan How do I know if a dentist is in the MetLife. Preferred Dentist Program (PDP)?. MetLife TakeAlong Dental · Expansive network of dental providers · More savings when you stay in-network · No paperwork; in- or out-of-network dentists submit.

If you and your loved ones are covered by Metlife dental insurance, finding an in-network dentist is a great way to ensure that you are able to take full. The MetLife TakeAlong Dental Discount Program provides nationwide dental benefits for every stage of your life. what your insurance plan will pay for fillings, root canals, gum treatments, and extractions. Most Metlife plans will cover % of the procedure costs. Dental Insurance should do more. The NCD by MetLife association dental plan provides members of the National Wellness and Fitness Association (NWFA) with. Not only does dental coverage help with the financial costs of dental care, it can also encourage regular dental checkups, which can be important for your oral. The MetLife® Federal Dental Plan · % coverage for in-network cleanings, X-rays and exams · Savings of up to 50% for in-network services such as fillings and. Having a good dental plan in place can help you save money every year! The MetLife Dental Insurance plan can help you keep up with your dental cleanings and. MetLife's Preferred Dentist Program is a dental PPO plan. You can visit any licensed dentist, in or out of the network, and receive benefits. • If you go to a. Benefit programs offered by MetLife contain certain exclusions, exceptions, waiting periods, reductions, limitations, and terms for keeping them in force. MetLife Dental Insurance offers a range of coverage to meet your needs and your budget. Learn more in this MetLife Dental Insurance review. Metlife Dental provides decent savings on group plans and is especially useful for small businesses looking for dental coverage. This plan typically offers the lowest out-of-pocket costs as long as you visit a dentist or specialist in the PPO network. You are allowed. Metlife dental insurance is worthless. They deny payment for just about everything a good dentist will order. They refuse to pay for crown replacement even. Dental PPO. •. Provides benefits for a broad range of covered services/procedures. •. Flexibility to choose any licensed dentist, in or out of the network. The MetLife dental plans are the traditional indemnity insurance plan How do I know if a dentist is in the MetLife. Preferred Dentist Program (PDP)?. Dental / Vision · Dental insurance makes it easy to go to the dentist by minimizing out-of-pocket costs for routine dental check-ups, expensive procedures and. MetLife Dental Insurance Coverage allows you to manage your dental benefits online & find resources to make informed choices about your dental health. MetLife Coverage Availability & Fees · Preventive care (cleanings, exams, bitewing X-rays, etc.): % covered · Basic restorative services (fillings, simple. Both MetLife and Delta Dental are trusted insurers, which makes them good choices for buying dental insurance, whether you are an employer creating a. GOOD NEWS! WE'RE IN NETWORK WITH METLIFE INSURANCE. Tend logo. Book. Meet your new dentist. Beautiful modern dental studios offering a full range of dental.

Can I Afford A Mortgage With My Salary

Our home affordability calculator helps you understand how much home you can afford based on your income and other debts. affordability calculator to determine how much you can afford based on your your monthly mortgage payment should be 28% of your gross monthly income. How much can you afford? Use our calculator to get an estimate on your price range that fits your budget, along with mortgage details. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Our home affordability calculator helps you understand how much home you can afford based on your income and other debts. affordability calculator to determine how much you can afford based on your your monthly mortgage payment should be 28% of your gross monthly income. How much can you afford? Use our calculator to get an estimate on your price range that fits your budget, along with mortgage details. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends. Your total housing costs should not be more than 28% of your gross monthly income. Your total debt payments should not be more than 36%. Debt-to-income-ratio . Lenders look at a debt-to-income (DTI) ratio when they consider your application for a mortgage loan. A DTI ratio is your monthly expenses compared to your. Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and. The best way to think about how much home you can afford is to consider what your maximum monthly mortgage can be. As a general rule of thumb, lenders limit. A general guideline for the mortgage you can afford is % to % of your gross annual income. However, the specific amount you can afford to borrow depends.

Ideally, borrowers should aim to spend 28% or less of their gross annual income on a mortgage. Monthly debt — Monthly debts impact how much of a mortgage you. The short answer is generally you should consider mortgage loans with a monthly payment that is 28% or less of your pre-tax monthly salary. As an example, let's. One influential factor in determining the amount of money you can borrow on a home loan is your debt-to-income (DTI) ratio. It is recommended that your DTI. Annual income only gives lenders a partial picture of your financial health. They also must consider your monthly debts and expenses. You'll need to add up any. To calculate "how much house can I afford," one rule of thumb is the 28/36 rule, which states that you shouldn't spend more than 28% of your gross monthly. Many people will tell you that the rule of thumb is you can afford a mortgage that is two to two-and-a-half times your gross (aka before taxes) annual salary. When you're buying a home, mortgage lenders don't look just at your income, assets, and the down payment you have. They look at all of your liabilities and. First, a standard rule for lenders is that your monthly housing payment should not take up more than 28% of your gross monthly income. That way you'll have. One rule of thumb is to aim for a home that costs about two-and-a-half times your gross annual salary. Lenders use your income to calculate your debt-to-income ratio, which helps them assess your ability to make monthly mortgage payments. The higher your income. Our Affordability Calculator offers a ballpark estimate of how much you'll be able to borrow — a first start in setting your expectations for buying a home. Affordability Calculation Factors. Income. First, add up the income that will be used to qualify for the mortgage, including bonuses and commissions. A simple. How Much Can You Afford? ; LOAN & BORROWER INFO. Calculate affordability by · Annual gross income · Must be between $0 and $,, · Annual gross income ; TAXES. Your total housing payment (including taxes and insurance) should be no more than 32 percent of your gross (pre-taxes) monthly income. The sum of your total. The 28% mortgage rule states that you should spend 28% or less of your monthly gross income on your mortgage payment (e.g., principal, interest, taxes and. It states that a household should spend no more than 28% of its gross monthly income on the front-end debt and no more than 36% of its gross monthly income on. To determine how much you can afford for your monthly mortgage payment, just multiply your annual salary by and divide the total by This will give. Housing ratio: Your housing ratio compares your monthly mortgage payment to your gross monthly income to ensure you can afford to pay your mortgage every month. Credit score and debt-to-income ratio (DTI) are significant factors when it comes to mortgage affordability. Improve these figures by paying down high-interest. To find out how much house you can afford, multiply your 5% down payment by 20 to find the price of the home you'll be able to buy (5% down payment x 20 = %.